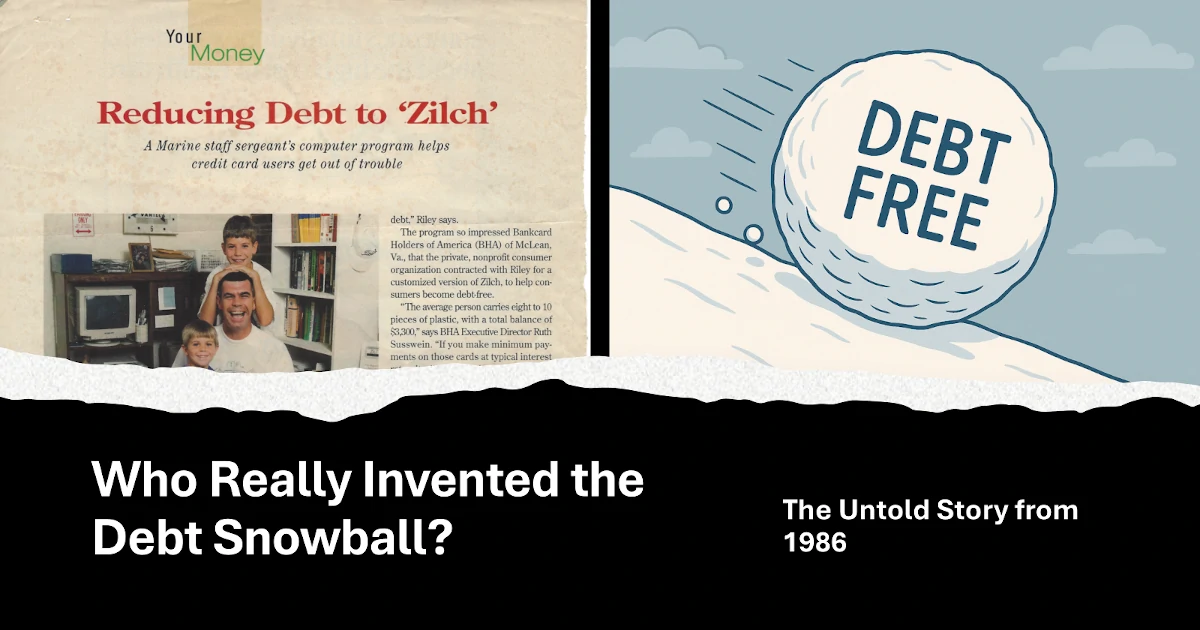

You may have always believed Dave Ramsey created the Debt Snowball. Learning the truth might surprise you, because the real story began in 1986 with a forgotten article and one Marine who turned the idea into the first calculator. Why does that matter? Because it proves this wasn’t born in a boardroom or packaged by a brand. It began with the struggles of ordinary families, sitting at kitchen tables, trying to make sense of bills that never seemed to shrink

That is why the Debt Snowball Calculator exists. Not to add another financial theory to the pile, but to give you a clear, practical path forward when you feel stuck. Today, you can see your own plan instantly and feel the relief of knowing there’s a finish line.

How a Military Chaplain Changed My Life

In 1986, I was a Marine Sergeant, but what I faced then may sound familiar to you now. Like many families, you may be juggling debts and living paycheck to paycheck, wondering how to make ends meet. That stress does more than tighten your budget — it chips away at your confidence, your relationships, even your sleep.

One day, a fellow sergeant handed me an article written by a Military Chaplain. His advice was simple, but it carried weight: pay off your smallest debt first. Build momentum. Stack wins. Let your progress encourage you to keep going until every debt is gone. Why did that idea matter? Because when you’re buried in bills, you don’t just need math — you need hope.

My friend asked me to help put the chaplain’s advice into action. We spread 20 bills across the table and worked through them one by one until a plan finally made sense. If you have ever stared at a pile of bills like that, you know the mix of panic and exhaustion it creates. That night, one thing became clear: people don’t just need a plan on paper, they need a tool that makes it faster, clearer, and doable. That moment planted the seed for the Debt Snowball Calculator — a way to turn overwhelming chaos into a path you can actually follow.

From Concept to Software: 1986 to 1991

By 1991, personal computers were finding their way into more homes. For families wrestling with piles of bills, that shift mattered. Suddenly, there was a chance to turn hours of confusion at the kitchen table into minutes of clarity on a screen. The world was changing, and debt payoff needed to change with it.

That is when an idea became a tool. What began as a Marine’s proof of concept turned into something anyone could use — not just theory, but a way to act. Why does that matter? Because ideas are interesting, but tools change lives.

The very first version of the Debt Snowball Calculator was released as shareware and given a name that said it all: Zilch. The goal was simple — reduce your debt to zero. Back then, people discovered it on floppy disks or bulletin board systems. They could try it at home, no strings attached, and decide if it was worth sending a check. That kind of trust mattered because it meant the calculator had to prove itself in people’s real lives.

What once took five hours with paper and pencil now took seconds. And for the first time, ordinary people could type in their debts, press a button, and see a finish line. Not just numbers, but a clear path: which debt to pay first, how much to send, and when freedom would come. That mattered because clarity replaces fear — and when you can see a finish line, you believe you can reach it.

How the Debt Snowball Works

When you first open the free Debt Snowball Calculator, what you see is simple — but what you feel is powerful. Instead of hours lost at the kitchen table, shuffling bills and guessing at numbers, the computer does the heavy lifting for you in seconds. That matters because clarity gives you back control.

And the path forward is easy, which is why it works:

- List all your debts. Writing them down feels overwhelming, but seeing them lined up on a screen gives you control instead of chaos.

- Order them from smallest balance to largest. Starting small matters, because quick wins build confidence faster than abstract math ever will.

- Pay the minimum on everything except the smallest debt. That single focus keeps you moving instead of stalling.

- Attack the smallest debt with everything extra. Why? Because watching one balance vanish is more motivating than waiting years to see progress.

- Roll that payment into the next debt. Every win fuels the next, giving you unstoppable momentum.

- Keep going until you’re debt-free. Not “someday,” but with a clear finish line you can actually see.

Suddenly, what once felt like a trap becomes a map. You no longer lie awake wondering, Which debt should I pay first? How much should I send? When will I be free? Now you have answers.

That’s the real breakthrough: the Debt Snowball is not just advice from a magazine or a theory in a book. It’s a plan you can trust, a plan you can follow, and a plan that proves freedom is possible one small win at a time.

Why Small Wins Beat Big Math

Critics say the snowball method doesn’t always save the most money compared to paying the highest interest first. And they’re right — in terms of math. But debt isn’t just math. If it were, none of us would ever fall behind. Debt is emotional. It’s the pressure in your chest, the dread of opening the mailbox, the shame of feeling stuck.

That’s why behavior matters more than formulas. Because when you see progress, even a little, it changes how you feel. The first small debt disappears and you feel relief. The second disappears and you feel confidence. By the third, you don’t just believe in the plan — you believe in yourself again.

That is why the snowball works. It doesn’t trick you into paying more; it frees you to keep going. People rarely quit on progress. You won’t either, because once you feel the momentum, you’ll want to keep moving until you’re free.

Real Results Over 34 Years

From a proof of concept in 1986 to shareware in 1991, to today’s online version, the Debt Snowball Calculator has been used by more than 16,000 people. Together, they’ve eliminated over 114 million dollars in debt — the kind of impact equal to wiping out every mortgage on Main Street in a small town.

One person told me, “This calculator saved my marriage.” Another said, “I finally see a finish line, and it feels like hope.” Those words matter because they remind us debt doesn’t just attack your wallet — it attacks your relationships, your health, your confidence. When the weight of debt lifts, people don’t just save money; they save pieces of their lives.

That’s why this method matters after nearly 40 years. It’s not about math on a spreadsheet. It’s about you being able to breathe again, repair what debt has strained, and finally believe that freedom is possible.

Dave Ramsey and the Snowball

So where does Dave Ramsey fit in?

He helped make the Debt Snowball a household name in the 2000s, and that deserves respect. But he didn’t invent it — and that detail matters. Why? Because knowing where it began reminds you this was never about branding or celebrity. It started with a chaplain’s words meant to help struggling families, and it grew into a tool designed to make life easier for people like you.

If there’s one regret, it’s that the original article wasn’t saved. In 1986, nobody could have predicted that almost 40 years later, people would still be talking about this plan and still looking back to that chaplain’s wisdom. If you had that clipping in your hands, you would have kept it safe too, because it carried hope.

And I know what it feels like to wonder if the paycheck will last, or to feel your chest tighten at the sight of a bill. That’s why this story matters — because I’ve been there too.

That history matters because it shows the Debt Snowball didn’t come from a boardroom. It came from someone who understood real struggle. And that’s why it still works for ordinary people today.

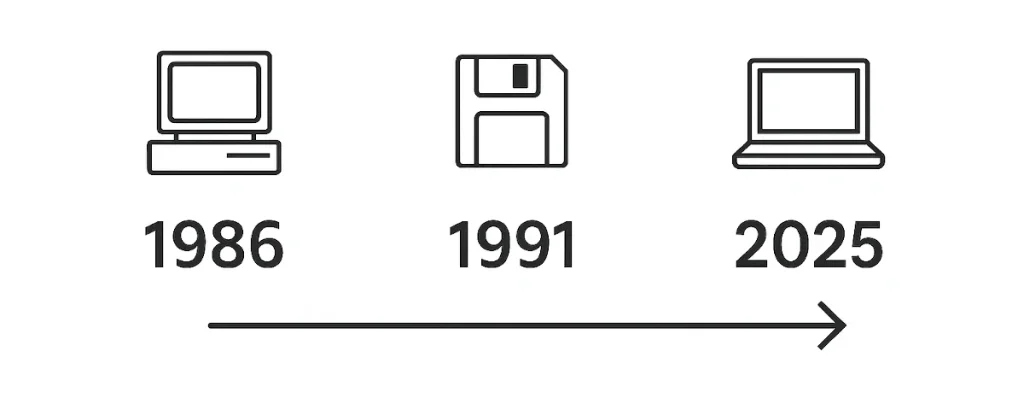

The Debt Snowball Timeline

1986 – Proof of Concept

It started with a Military Chaplain’s advice: pay off your smallest debt first and build momentum. Using a Tandy 1000SX, that idea was tested in a simple spreadsheet — proof that even the most overwhelming pile of bills could be turned into a clear plan. Why does that matter? Because it shows the Debt Snowball was never theory. It worked in real life, for real people, right from the start.

1991 – Shareware Launch

Five years later, that proof of concept became software called Zilch. Distributed on floppy disks and bulletin boards, it was one of the first tools that let ordinary people type in their debts, push a button, and instantly see a payoff plan. Why does that matter? Because for the first time, anyone could see a finish line instead of just a mountain of debt.

2025 – Free Online Release

Today, the very same calculator is online, completely free. Why does that matter? Because if one Marine with a spreadsheet could change his family’s future, then you — with the power of this tool in your hands — can change yours too.

Why I’m Making the Calculator Free Today

For years, the Debt Snowball Calculator was sold as desktop software. People bought it, installed it, and used it to wipe out millions in debt. But here’s the truth: the heart of this tool was never about selling software. It was about giving families a way to breathe again.

That’s why the original version — the same one that started it all — is now free online. Why does that matter? Because everyone deserves a fighting chance to get out of debt, not just those who can afford another program.

If one short article from a Military Chaplain could change the direction of a young Marine’s life, then this calculator — simple, clear, and proven — might change yours too. Not because it’s free, but because it gives you something debt has tried to take away: hope.

Try the Free Debt Snowball Calculator Online

If you’ve ever wondered:

- How long will it take me to pay off my debts?

- What’s the smartest order to pay them in?

- How much money could I free up as I go?

…this calculator will give you answers in minutes.

👉 Try the Free Debt Snowball Calculator Online

A Final Word

Debt can feel like quicksand. The harder you fight, the deeper you sink. That is why so many people give up — not because they can’t do the math, but because they lose hope. The right strategy matters because it gives you a way out, one step at a time.

The snowball method proves that small wins create big change. It turned a pile of twenty bills on a kitchen table into the first proof of concept in 1986. It gave thousands of people clarity when the first software was released in 1991. And it can give you the same clarity today, with the free Debt Snowball Calculator.

That Military Chaplain’s words mattered then because they gave struggling families hope. They matter now because they are being passed on to you. And that is the real story: not just where the Debt Snowball came from, but where it can take you. The story is now yours to finish. Where will it take you?

Some of the images you’ve seen here are authentic snapshots from my journey. Others are illustrative, included to capture the spirit of the story. Together, they bring the Debt Snowball to life in a way that words alone can’t.