Have you ever tried to figure out your credit card minimum payment using your cardholder agreement? It’s like reading a foreign language. The wording is slick, the formulas are buried, and the design is intentional. It’s not your fault if you don’t understand it — it was written to confuse, not to clarify.

Here’s how different credit card companies explain minimum payments in their own words:

But here’s the truth: once you strip away the jargon, calculating your minimum payment is actually pretty simple. I’ll walk you through it step by step, using real examples, so you can see exactly how the numbers add up. By the end, you’ll understand the system better than the banks want you to — and that knowledge puts you in control.

Step 1: Start With Your Balance and APR

Every credit card statement lists two key numbers: your balance and your APR (annual percentage rate). These are the foundation of your minimum payment.

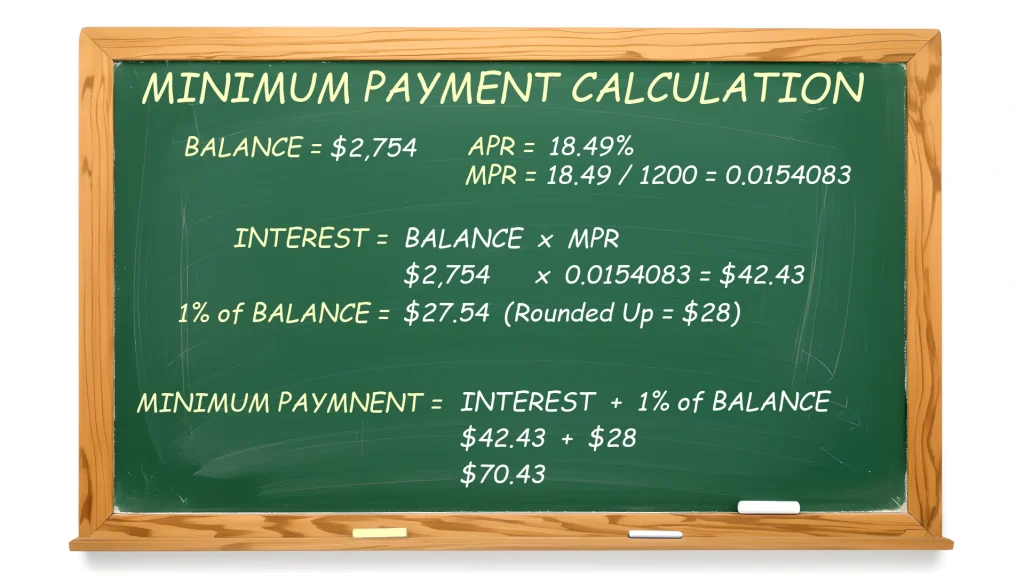

In our example, the balance is $2,754 and the APR is 18.49%. Keep those two numbers in mind, because everything else builds from here.

Step 2: Convert APR Into a Monthly Rate

Credit card companies don’t charge you interest once a year. They slice that APR into tiny monthly chunks. To get the monthly periodic rate (MPR), divide the APR by 12 months and then by 100.

For our example, 18.49% ÷ 12 ÷ 100 = 0.0154083. That’s the interest rate applied to your balance each month.

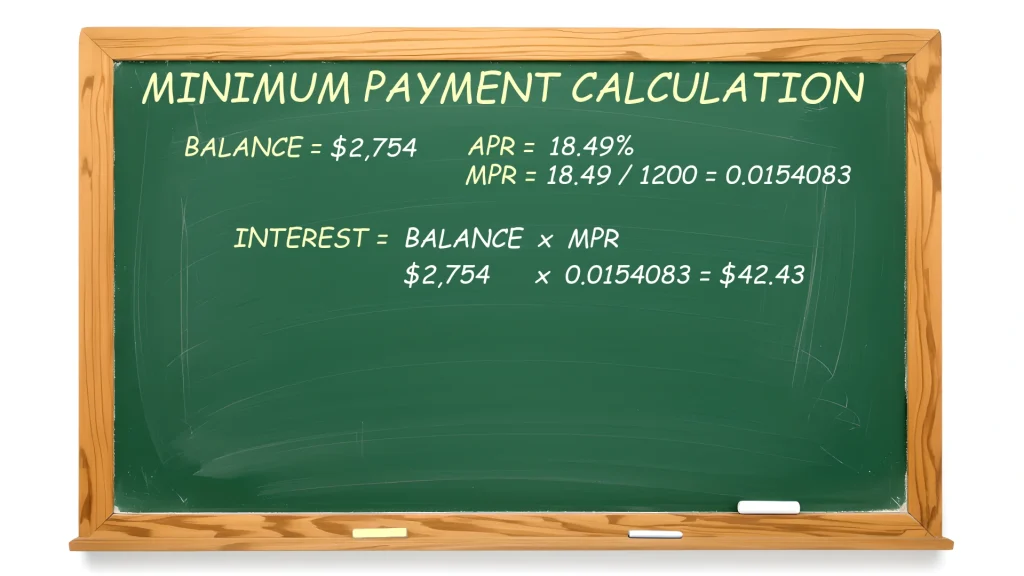

Step 3: Calculate the Interest Part of Your Credit Card Minimum Payment

Now that we know the monthly rate, we can calculate the interest portion of your minimum payment. Just multiply your balance by the MPR.

$2,754 × 0.0154083 = $42.43. This is the bank’s cut for lending you money. Notice how this part is always guaranteed in their formula.

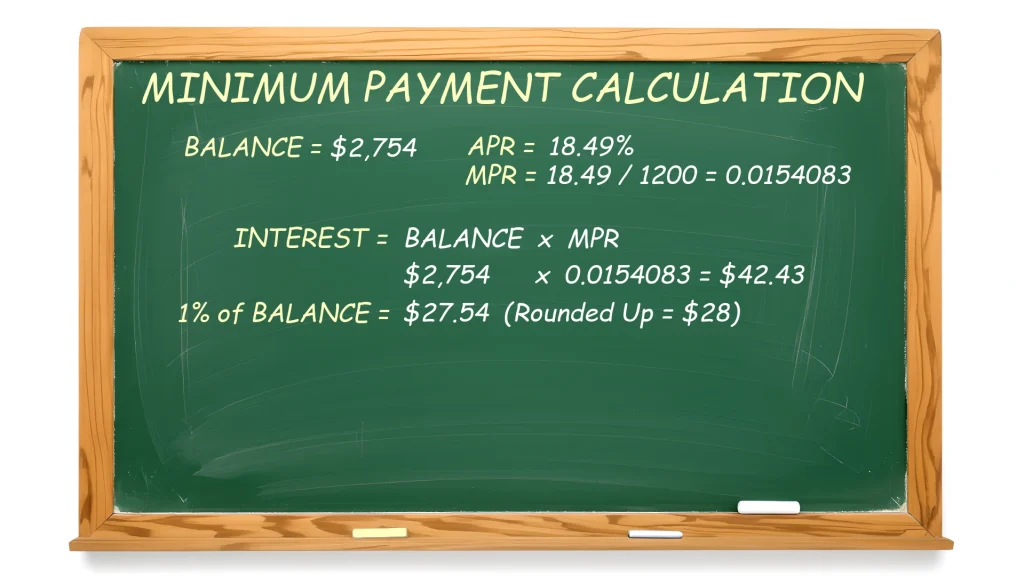

Step 4: Add a Percentage of the Balance

Credit card companies don’t stop at interest. They also add a small percentage of your balance. This ensures you’re making progress — but very slowly.

In this case, 1% of $2,754 = $27.54. Most banks round it up, so your minimum includes $28 from the balance itself.

Step 5: Add It Up for Your Final Credit Card Minimum Payment

Finally, your minimum payment is the sum of interest plus that balance percentage.

$42.43 (interest) + $28 (balance) = $70.43. That’s the number your bank will demand on your statement. Now you know exactly how they get it.

You’ve just learned how credit card minimum payments are calculated — and that’s a big win. Most people never take the time to understand this, but now you’ve got the clarity the banks hope you’ll never have.

Here’s the hard truth: if you stick with minimums, the banks come out ahead. Interest piles up, and what looks like a small $70 payment can drag on for years, costing you thousands extra. That’s not an accident — it’s how the system is designed.

The good news? You don’t have to stay stuck in their game. ZilchWorks takes the math you just learned and shows you how to build a real payoff plan you can follow. Instead of crawling along with minimums, you’ll see how to pay off your cards faster, save money, and finally take control.

If you’d like to explore the emotional side of this struggle, check out this reverse poem about debt. It captures what minimum payments really feel like for so many people.