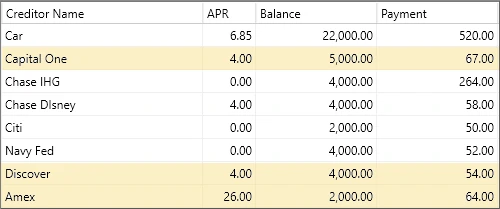

Recently, I came across a post on Reddit’s r/personalfinance.

The original poster listed their credit card balances and minimum payments. At first glance, everything looked fine — but when I checked their math, I noticed the minimum payments didn’t add up. That small mistake makes a big difference in how long debt hangs around.

This real-world example shows how easy it is to underestimate your payments, and how the right strategy can cut years off your debt payoff timeline.

Step 1: Correcting the Minimum Payments

Minimum payments are usually calculated like this:

Minimum Payment = (APR ÷ 1200 × Balance) + (Balance × 1%)

When I ran the numbers, here’s what the corrected minimums looked like:

- Capital One → about $68

- Discover → about $54

- Amex → about $64

That bumped their true minimum payments by $33 (from $1,096 → $1,129).

Step 2: Running the Payoff Scenarios

The Redditor mentioned they were saving $1,300 a month. If even part of that goes toward debt payoff, things accelerate quickly.

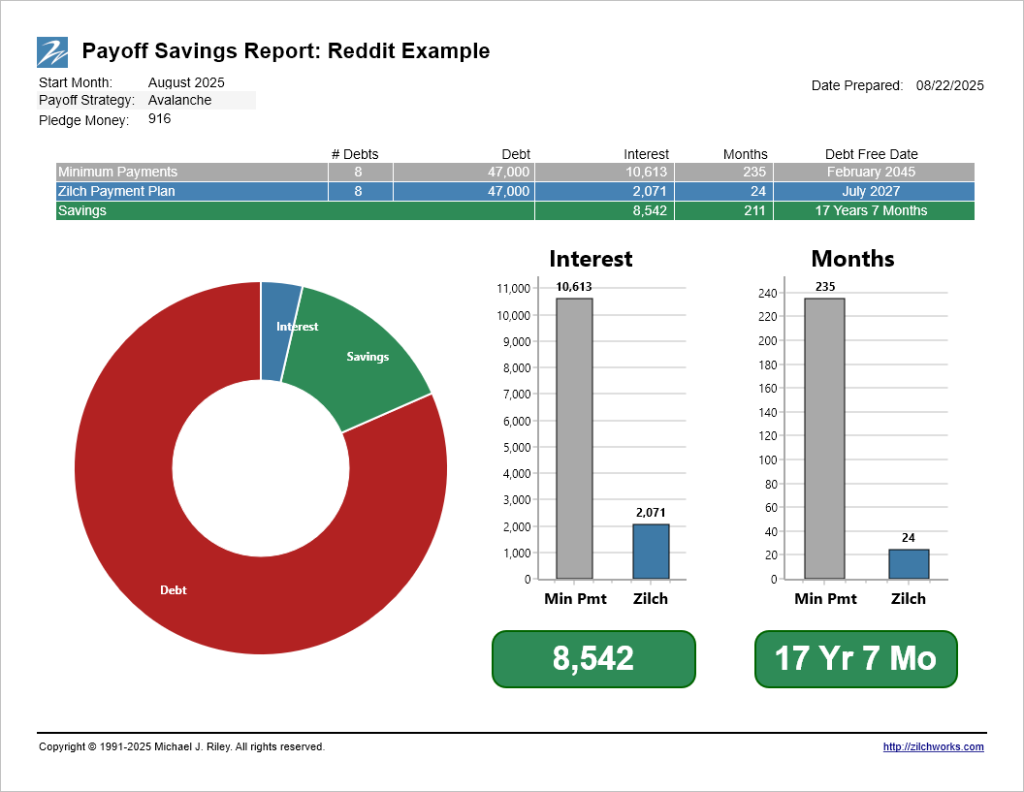

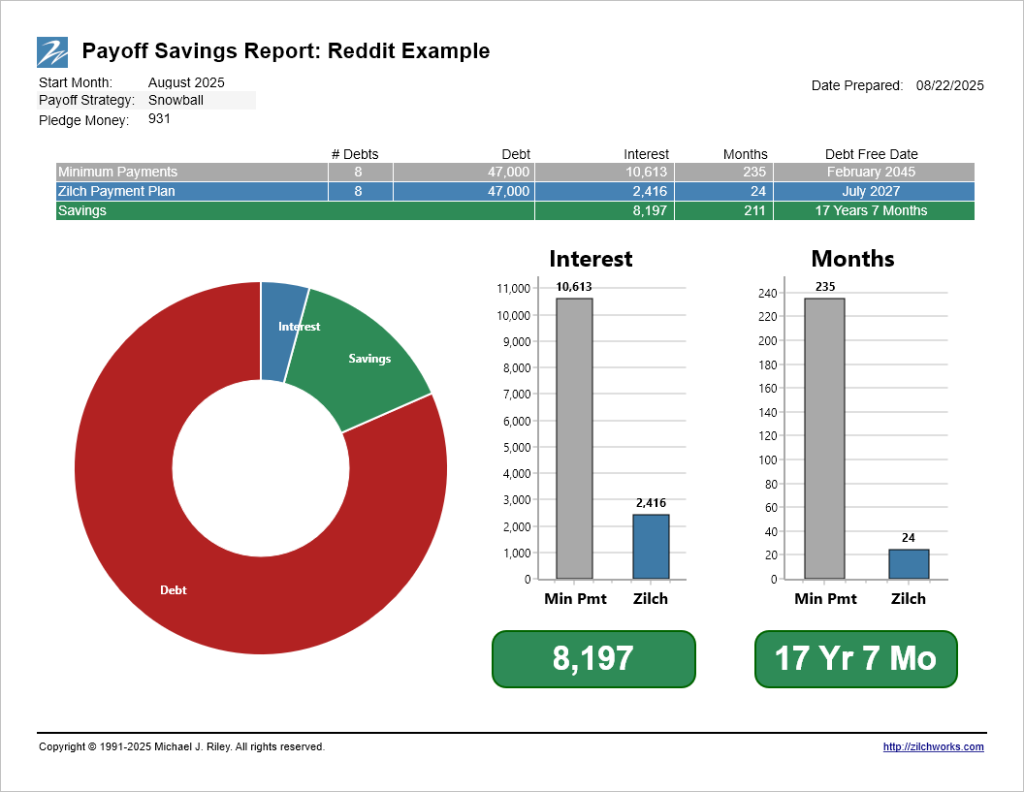

I ran two scenarios: Avalanche (highest APR first) and Snowball (smallest balance first).

Here’s what the payoff looks like:

Avalanche method (highest APR first):

- 46 months = minimums only

- 30 months = +$528 extra each month

- 24 months = +$916 extra each month

Snowball method (smallest balance first):

- 47 months = minimums only

- 30 months = +$540 extra each month

- 24 months = +$931 extra each month

Step 3: The Mission Mindset

As a retired Marine, this reminds me of something we always said:

Discipline beats motivation.

The math is straightforward — the real challenge is holding the line for 24 months without adding new debt. Think of it like a deployment: not easy, but temporary, and with a clear end date.

Lessons From This Reddit Case

- Check your minimums. Don’t assume the number on your statement is the whole picture.

- Use a plan. Avalanche or Snowball both work, the key is consistency.

- Leverage savings. Redirecting even part of monthly savings toward debt changes the timeline dramatically.

- Stay disciplined. Overspending resets the clock.

Closing Thoughts

This Redditor’s situation is not unique. Thousands of people are in the same boat. The good news is that with the right plan and some discipline, they could be debt-free in just 24 months.

We have been helping people get out of debt since 1991 with our Zilch software, available for just $69.95. Learn more here → https://zilchworks.com

If paying is not an option right now, we also offer a free Debt Snowball Calculator so anyone can start their journey toward freedom. Try it here → Free Debt Calculator.

Numbers do not lie. Seeing your payoff timeline in black and white can be the motivation you need to stay on mission.

Semper Fi,

Gunny Mike